Principal-agent problem

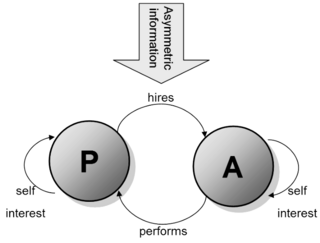

In political science and economics, the principal–agent problem or agency dilemma treats the difficulties that arise under conditions of incomplete and asymmetric information when a principal hires an agent, such as the problem that the two may not have the same interests, while the principal is, presumably, hiring the agent to pursue the interests of the former.

Various mechanisms may be used to try to align the interests of the agent in solidarity with those of the principal, such as piece rates/commissions, profit sharing, efficiency wages, performance measurement (including financial statements), the agent posting a bond, or fear of firing.

The principal–agent problem is found in most employer/employee relationships, for example, when stakeholders hire top executives of corporations. Numerous studies in political science have noted the problems inherent in the delegation of legislative authority to bureaucratic agencies.

As another example, the implementation of legislation (such as laws and executive directives) is open to bureaucratic interpretation, which creates opportunities and incentives for the bureaucrat-as-agent to deviate from the intentions or preferences of the legislators. Variance in the intensity of legislative oversight also serves to increase principal–agent problems in implementing legislative preferences.

Overview

In political science and economics, the problem of motivating a party to act on behalf of another is known as ‘the principal–agent problem’. The principal–agent problem arises when a principal compensates an agent for performing certain acts that are useful to the principal and costly to the agent, and where there are elements of the performance that are costly to observe. This is the case to some extent for all contracts that are written in a world of information asymmetry, uncertainty and risk.

Here, principals do not know enough about whether (or to what extent) a contract has been satisfied. The solution to this information problem — closely related to the moral hazard problem — is to ensure the provision of appropriate incentives so agents act in the way principals wish.

In terms of game theory, it involves changing the rules of the game so that the self-interested rational choices of the agent coincide with what the principal desires. Even in the limited arena of employment contracts, the difficulty of doing this in practice is reflected in a multitude of compensation mechanisms (‘the carrot’) and supervisory schemes (‘the stick’), as well as in critique of such mechanisms as e.g. Deming (1986) expresses in his Seven Deadly Diseases of management. A distinct and relatively new meaning of the principal–agent problem describes the landlord-tenant relationship as a barrier to energy savings.

This use of the term is described below in the section on the principal–agent problem in energy efficiency. The problem is also discussed in terms of "agency theory".[1]

Employment contract

In the context of the employment contract, individual contracts form a major method of restructuring incentives, by connecting as closely as is optimal the information available about employee performance, and the compensation for that performance. Because of differences in the quantity and quality of information available about the performance of individual employees, the ability of employees to bear risk, and the ability of employees to manipulate evaluation methods, the structural details of individual contracts vary widely, including such mechanisms as “piece rates, [share] options, discretionary bonuses, promotions, profit sharing, efficiency wages, deferred compensation, and so on.” (Prendergast 1999, 7) Typically, these mechanisms are used in the context of different types of employment: salespeople often receive some or all of their remuneration as commission, production workers are usually paid an hourly wage, while office workers are typically paid monthly or semimonthly (and if paid overtime, typically at a higher rate than the hourly rate implied by the salary). The way in which these mechanisms are used is different in the two parts of the economy which Doeringer and Piore called the “primary” and “secondary” sectors (see also dual labour market).

The secondary sector is characterised by short-term employment relationships, little or no prospect of internal promotion, and the determination of wages primarily by market forces. In terms of occupations, it consists primarily of low or unskilled jobs, whether they are blue-collar (manual-labour), white-collar (e.g. filing clerks), or service jobs (e.g. waiters). These jobs are linked by the fact that they are characterized by “low skill levels, low earnings, easy entry, job impermanence, and low returns to education or experience.” In a number of service jobs, such as food service, golf caddying, and valet parking jobs, workers in some countries are paid mostly or entirely with tips.

The use of tipping is a strategy on the part of the owners or managers to align the interests of the service workers with those of the owners or managers; the service workers have an incentive to provide good customer service (thus benefiting the company's business), because this makes it more likely that they will get a good tip. As a solution to the principal–agent problem, though, tipping is not perfect. In the hopes of getting a larger tip, a server, for example, may be inclined to give a customer an extra large glass of wine or a second scoop of ice cream. While these larger servings make the customer happy and increase the likelihood of the server getting a good tip, they cut into the profit margin of the restaurant. In addition, a server may dote on generous tippers while ignoring other customers, and in rare cases harangue bad tippers.

Non-financial compensation

Part of this variation in incentive structures and supervisory mechanisms may be attributable to variation in the level of intrinsic psychological satisfaction to be had from different types of work. Sociologists and psychologists frequently argue that individuals take a certain degree of pride in their work, and that introducing performance-related pay can destroy this “psycho-social compensation”, because the exchange relation between employer and employee becomes much more narrowly economic, destroying most or all of the potential for social exchange. Evidence for this is inconclusive – Deci (1971), and Lepper, Greene and Nisbett (1973) find support for this argument; Staw (1989) suggests other interpretations of the findings.

Team production

On a related note, Drago and Garvey (1997) use Australian survey data to show that when agents are placed on individual pay-for-performance schemes, they are less likely to help their coworkers. This negative effect is particularly important in those jobs that involve strong elements of ‘team production’ (Alchian and Demsetz 1972), where output reflects the contribution of many individuals, and individual contributions cannot be easily identified, and compensation is therefore based largely on the output of the team. In other words, pay-for-performance increases the incentives to free-ride, as there are large positive externalities to the efforts of an individual team member, and low returns to the individual (Holmstrom 1982, McLaughlin 1994).

The negative incentive effects implied are confirmed by some empirical studies, (e.g., Newhouse, 1973) for shared medical practices; costs rise and doctors work fewer hours as more revenue is shared). Leibowitz and Tollison (1980) find that larger law partnerships typically result in worse cost containment. As a counter, peer pressure can potentially solve the problem (Kandel and Lazear 1992), but this depends on peer monitoring being relatively costless to the individuals doing the monitoring/censuring in any particular instance (unless one brings in social considerations of norms and group identity and so on). Studies suggest that profit-sharing, for example, typically raises productivity by 3-5% (Jones and Kato 1995, Knez and Simester 2001), although there are some selection issues (Prendergast)..

Empirical evidence

There is however considerable empirical evidence of a positive effect of compensation on performance (although the studies usually involve “simple” jobs where aggregate measures of performance are available, which is where piece rates should be most effective). In one study, Lazear (1996) saw productivity rising by 44% (and wages by 10%) in a change from salary to piece rates, with a half of the productivity gain due to worker selection effects.

- Paarsch and Shearer (1996) also find evidence supportive of incentive and productivity effects from piece rates, as do Banker, Lee, and Potter (1996), although the latter do not distinguish between incentive and worker selection effects.

- Fernie and Metcalf (1996) find that top British jockeys perform significantly better when offered percentage of prize money for winning races compared to being on fixed retainers.

- McMillan, Whalley and Zhu (1989) and Groves et al. (1994) look at Chinese agricultural and industrial data respectively and find significant incentive effects.

- Kahn and Sherer (1990) find that better evaluations of white-collar office workers were achieved by those employees who had a steeper relation between evaluations and pay.

- Nikkinen and Sahlström (2004) find empirical evidence that agency theory can be used, at least to some extent, to explain financial audit fees internationally.

Contract design

Milgrom and Roberts (1992) identify four principles of contract design: When perfect information is not available, Holmstrom (1979) developed the Informativeness Principle to solve this problem. This essentially states that any measure of performance that (on the margin) reveals information about the effort level chosen by the agent should be included in the compensation contract. This includes, for example, Relative Performance Evaluation – measurement relative to other, similar agents, so as to filter out some common background noise factors, such as fluctuations in demand. By removing some exogenous sources of randomness in the agent’s income, a greater proportion of the fluctuation in the agent’s income falls under his control, increasing his ability to bear risk. If taken advantage of, by greater use of piece rates, this should improve incentives. (In terms of the simple linear model below, this means that increasing x produces an increase in b.)

However, setting incentives as intense as possible is not necessarily optimal from the point of view of the employer. The Incentive-Intensity Principle states that the optimal intensity of incentives depends on four factors: the incremental profits created by additional effort, the precision with which the desired activities are assessed, the agent’s risk tolerance, and the agent’s responsiveness to incentives. According to Prendergast (1999, 8), “the primary constraint on [performance-related pay] is that [its] provision imposes additional risk on workers…” A typical result of the early principal–agent literature was that piece rates tend to 100% (of the compensation package) as the worker becomes more able to handle risk, as this ensures that workers fully internalize the consequences of their costly actions. In incentive terms, where we conceive of workers as self-interested rational individuals who provide costly effort (in the most general sense of the worker’s input to the firm’s production function), the more compensation varies with effort, the better the incentives for the worker to produce.

The third principle – the Monitoring Intensity Principle – is complementary to the second, in that situations in which the optimal intensity of incentives is high correspond to situations in which the optimal level of monitoring is also high. Thus employers effectively choose from a “menu” of monitoring/incentive intensities. This is because monitoring is a costly means of reducing the variance of employee performance, which makes more difference to profits in the kinds of situations where it is also optimal to make incentives intense.

The fourth principle is the Equal Compensation Principle, which essentially states that activities equally valued by the employer should be equally valuable (in terms of compensation, including non-financial aspects such as pleasantness of the workplace) to the employee. This relates to the problem that employees may be engaged in several activities, and if some of these are not monitored or are monitored less heavily, these will be neglected, as activities with higher marginal returns to the employee are favoured. This can be thought of as a kind of “disintermediation” – targeting certain measurable variables may cause others to suffer. For example, teachers being rewarded by test scores of their students are likely to tend more towards teaching ‘for the test’, and de-emphasise less relevant but perhaps equally or more important aspects of education; while AT&T’s practice at one time of rewarding programmers by the number of lines of code written resulted in programs that were longer than necessary – i.e. program efficiency suffering (Prendergast 1999, 21). Following Holmstom and Milgrom (1990) and Baker (1992), this has become known as “multi-tasking” (where a subset of relevant tasks is rewarded, non-rewarded tasks suffer relative neglect). Because of this, the more difficult it is to completely specify and measure the variables on which reward is to be conditioned, the less likely that performance-related pay will be used: “in essence, complex jobs will typically not be evaluated through explicit contracts.” (Prendergast 1999, 9).

Where explicit measures are used, they are more likely to be some kind of aggregate measure, for example, baseball and American Football players are rarely rewarded on the many specific measures available (e.g. number of home runs), but frequently receive bonuses for aggregate performance measures such as Most Valuable Player. The alternative to objective measures is subjective performance evaluation, typically by supervisors. However, there is here a similar effect to “multi-tasking”, as workers shift effort from that subset of tasks which they consider useful and constructive, to that subset which they think gives the greatest appearance of being useful and constructive, and more generally to try to curry personal favour with supervisors. (One can interpret this as a destruction of organizational social capital – workers identifying with, and actively working for the benefit of, the firm – in favour of the creation of personal social capital – the individual-level social relations which enable workers to get ahead (“networking”).)

Linear model

The four principles can be summarised in terms of the simplest (linear) model of incentive compensation:

- <math>

w = a + b(e + x + gy) </math>

where w stands for the wage, e for (unobserved) effort, x for unobserved exogenous effects on outcomes, and y for observed exogenous effects; while g and a represent the weight given to y, and the base salary, respectively. The interpretation of b is as the intensity of incentives provided to the employee.

The above discussion on explicit measures assumed that contracts would create the linear incentive structures summarised in the model above. But while the combination of normal errors and the absence of income effects yields linear contracts, many observed contracts are nonlinear. To some extent this is due to income effects as workers rise up a tournament/hierarchy: “Quite simply, it may take more money to induce effort from the rich than from the less well off.” (Prendergast 1999, 50). In addition, the marginal return to effort may increase: it is more important for a CEO to work hard than for a shop floor worker (eg Murphy 1998 highlights the importance of bonuses for executives). Similarly, the threat of being fired creates a nonlinearity in wages earned versus performance. Moreover, many empirical studies illustrate inefficient behaviour arising from nonlinear objective performance measures, or measures over the course of a long period (eg a year), which create nonlinearities in time due to discounting behaviour. This inefficient behaviour arises because incentive structures are varying: for example, when a worker has already exceeded a quota or has no hope of reaching it, versus being close to reaching it – eg Healy (1985), Oyer (1997), Leventis (1997). Leventis shows that New York surgeons, penalised for exceeding a certain mortality rate, take less risky cases as they approach the threshold. Courty and Marshke (1997) provide evidence on incentive contracts offered to agencies, which receive bonuses on reaching a quota of graduated trainees within a year. This causes them to ‘rush-graduate’ trainees in order to make the quota.

Performance evaluation

Objective performance evaluation

The major problem in measuring employee performance in cases where it is difficult to draw a straightforward connection between performance and profitability is the setting of a standard by which to judge the performance. One method of setting an absolute objective performance standard—rarely used because it is costly and only appropriate for simple repetitive tasks—is time-and-motion studies, which study in detail how fast it is possible to do a certain task. These have been used constructively in the past, particularly in manufacturing. More generally, however, even within the field of objective performance evaluation, some form of relative performance evaluation must be used. Typically this takes the form of comparing the performance of a worker to that of his peers in the firm or industry, perhaps taking account of different exogenous circumstances affecting that.

The reason that employees are often paid according to hours of work rather than by direct measurement of results is that it is often more efficient to use indirect systems of controlling the quantity and quality of effort, due to a variety of informational and other issues (e.g. turnover costs, which determine the optimal minimum length of relationship between firm and employee). This means that methods such as deferred compensation and structures such as tournaments are often more suitable to create the incentives for employees to contribute what they can to output over longer periods (years rather than hours). These represent “pay-for-performance” systems in a looser, more extended sense, as workers who consistently work harder and better are more likely to be promoted (and usually paid more), compared to the narrow definition of “pay-for-performance”, such as piece rates. This discussion has been conducted almost entirely for self-interested rational individuals. In practice, however, the incentive mechanisms which successful firms use take account of the socio-cultural context they are embedded in (Fukuyama 1995, Granovetter 1985), in order not to destroy the social capital they might more constructively mobilise towards building an organic, social organization, with the attendant benefits from such things as “worker loyalty and pride (...) [which] can be critical to a firm’s success...” (Sappington 1991,63)

Subjective performance evaluation

Subjective performance evaluation allows the use of a subtler, more balanced assessment of employee performance, and is typically used for more complex jobs where comprehensive objective measures are difficult to specify and/or measure. Whilst often the only feasible method, the attendant problems with subjective performance evaluation have resulted in a variety of incentive structures and supervisory schemes. One problem, for example, is that supervisors may under-report performance in order to save on wages, if they are in some way residual claimants, or perhaps rewarded on the basis of cost savings. This tendency is of course to some extent offset by the danger of retaliation and/or demotivation of the employee, if the supervisor is responsible for that employee’s output. As an example, there have been numerous cases where net profits were apparently underreported on successful Guy Ritchie films, where actors or writers had been promised a percentage of net profits – Cheatham, David, and Cheatham (1996).

Another problem relates to what is known as the “compression of ratings”. Two related influences – centrality bias, and leniency bias—have been documented (Landy and Farr 1980, Murphy and Cleveland 1991). The former results from supervisors being reluctant to distinguish critically between workers (perhaps for fear of destroying team spirit), while the latter derives from supervisors being averse to offering poor ratings to subordinates, especially where these ratings are used to determine pay, not least because bad evaluations may be demotivating rather than motivating. However, these biases introduce noise into the relationship between pay and effort, reducing the incentive effect of performance-related pay. Milkovich and Wigdor (1991) suggest that this is the reason for the common separation of evaluations and pay, with evaluations primarily used to allocate training.

Finally, while the problem of compression of ratings originates on the supervisor-side, related effects occur when workers actively attempt to influence the appraisals supervisors give, either by influencing the performance information going to the supervisor: multitasking (focussing on the more visibly productive activities – Paul 1992), or by working “too hard” to signal worker quality or create a good impression (Holmstrom 1982); or by influencing the evaluation of it, eg by “currying influence” (Milgrom and Roberts 1988) or by outright bribery (Tirole 1992).

Incentive structures

Tournaments

Much of the discussion here has been in terms of individual pay-for-performance contracts; but many large firms use internal labour markets (Doeringer and Piore 1971, Rosen 1982) as a solution to some of the problems outlined. Here, there is “pay-for-performance” in a looser sense over a longer time period. There is little variation in pay within grades, and pay increases come with changes in job or job title (Gibbs and Hendricks 1996). The incentive effects of this structure are dealt with in what is known as “tournament theory” (Lazear and Rosen 1981, Green and Stokey (1983), see Rosen (1986) for multi-stage tournaments in hierarchies where it is explained why CEOs are paid many times more than other workers in the firm). See the superstar article for more information on the tournament theory.

Workers are motivated to supply effort by the wage increase they would earn if they win a promotion. Some of the extended tournament models predict that relatively weaker agents, be they competing in a sports tournaments (Becker and Huselid 1992, in NASCAR racing) or in the broiler chicken industry (Knoeber and Thurman 1994), would take risky actions instead of increasing their effort supply as a cheap way to improve the prospects of winning. These actions are inefficient as they increase risk taking without increasing the average effort supplied.

A major problem with tournaments is that individuals are rewarded based on how well they do relative to others. Co-workers might become reluctant to help out others and might even sabotage others' effort instead of increasing their own effort (Lazear 1989, Rob and Zemsky 1997). This is supported empirically by Drago and Garvey (1997). Why then are tournaments so popular? Firstly, because – especially given compression rating problems – it is difficult to determine absolutely differences in worker performance. Tournaments merely require rank order evaluation. Secondly, it reduces the danger of rent-seeking, because bonuses paid to favourite workers are tied to increased responsibilities in new jobs, and supervisors will suffer if they do not promote the most qualified person. Thirdly, where prize structures are (relatively) fixed, it reduces the possibility of the firm reneging on paying wages. As Carmichael (1983) notes, a prize structure represents a degree of commitment, both to absolute and to relative wage levels. Lastly when the measurement of workers' productivity is difficult, e.g. say monitoring is costly, or when the tasks the workers have to perform for the job is varied in nature, making it hard to measure effort and/or performance, then running tournaments in a firm would encourage the workers to supply effort whereas workers would have shirked if there are no promotions.

Tournaments also promote risk seeking behavior. In essence, the compensation scheme becomes more

like a call option on performance (which increases in value with increased volatility (cf. options pricing).

If you are one of ten players competing for the asymmetrically large top prize, you may benefit from reducing the expected

value of your overall performance to the firm in order to increase your chance that you have an outstanding performance

(and win the prize). In moderation this can offset the greater risk aversion of agents vs principals because their social capital is concentrated in their employer while in the case of public companies the principal typically owns his stake as part of a diversified portfolio. Successful innovation is particularly dependent on employees' willingness to take risks. In cases with extreme incentive intensity, this sort of behavior can create catastrophic organizational failure. If the principal owns the firm as part of a diversified portfolio this may be a price worth paying for the greater chance of success through innovation elsewhere in the portfolio. If however the risks taken are systematic and cannot be diversified e.g. exposure to general housing prices, then such failures will damage the interests of principals and even the economy as a whole.

(cf. Kidder Peabody, Barings, Enron, AIG to name a few). Ongoing periodic catastrophic organizational failure

is directly incentivized by tournament and other superstar/Winner take all compensation systems.

[Holt 1995].

Deferred compensation

Tournaments represent one way of implementing the general principle of “deferred compensation”, which is essentially an agreement between worker and firm to commit to each other. Under schemes of deferred compensation, workers are overpaid when old, at the cost of being underpaid when young. Salop and Salop (1976) argue that this derives from the need to attract workers more likely to stay at the firm for longer periods, since turnover is costly. Alternatively, delays in evaluating the performance of workers may lead to compensation being weighted to later periods, when better and poorer workers have to a greater extent been distinguished. (Workers may even prefer to have wages increasing over time, perhaps as a method of forced saving, or as an indicator of personal development. eg Loewenstein and Sicherman 1991, Frank and Hutchens 1993.) For example Akerlof and Katz 1989: if older workers receive efficiency wages, younger workers may be prepared to work for less in order to receive those later. Overall, the evidence suggests the use of deferred compensation (eg Freeman and Medoff 1984, and Spilerman 1986 – seniority provisions are often included in pay, promotion and retention decisions, irrespective of productivity.)

Other applications

The "principal–agent problem" has also been discussed in the context of energy consumption by Jaffe and Stavins in 1994. They were attempting to catalog market and non-market barriers to energy efficiency adoption. In efficiency terms, a market failure arises when a technology which is both cost-effective and saves energy is not implemented. Jaffe and Stavins describe the common case of the landlord-tenant problem with energy issues as a principal–agent problem. “[I]f the potential adopter is not the party that pays the energy bill, then good information in the hands of the potential adopter may not be sufficient for optimal diffusion; adoption will only occur if the adopter can recover the investment from the party that enjoys the energy savings. Thus, if it is difficult for the possessor of information to convey it credibly to the party that benefits from reduced energy use, a principal/agent problem arises.” [2]

The energy efficiency use of the principal agent terminology is in fact distinct from the usual one in several ways. In landlord/tenant or more generally equipment-purchaser / energy-bill-payer situations, it is often difficult to describe who would be the principal and who the agent. Is the agent the landlord and the principal the tenant, because the landlord is “hired” by the tenant through the payment of rent? As (Murtishaw and Sathaye, 2006) point out, “In the residential sector, the conceptual definition of principal and agent must be stretched beyond a strictly literal definition.”

Another distinction is that the principal agent problem in energy efficiency does not require any information asymmetry: both the landlord and the tenant may be aware of the overall costs and benefits of energy-efficient investments, but as long as the landlord pays for the equipment and the tenant pays the energy bills, the investment in new, energy-efficient appliances will not be made. In this case, there is also little incentive for the tenant to make a capital efficiency investment with a usual payback time of several years, and which in the end will revert to the landlord as property. Since energy consumption is determined both by technology and by behavior, an opposite principal agent problem arises when the energy bills are paid by the landlord, leaving the tenant with no incentive to moderate her energy use. This is often the case for leased office space, for example.

The energy efficiency principal agent problem applies in many cases to rented buildings and apartments, but arises in other circumstances, most often involving relatively high up-front costs for energy-efficient technology. Though it is challenging to assess exactly, the principal agent problem is considered to be a major barrier to the diffusion of efficient technologies. This can be addressed in part by promoting shared-savings performance-based contracts, where both parties benefit from the efficiency savings. The issues of market barriers to energy efficiency, and the principal agent problem in particular, are receiving renewed attention because of the importance of global climate change and rising prices of the finite supply of fossil fuels. The principal–agent problem in energy efficiency is the topic of an International Energy Agency report: [3] "Mind the Gap—Quantifying Principal–Agent Problems in Energy Efficiency" (2007).

Flyvbjerg and Cowi (2004) explained systematic and large cost overruns in the provision of major transportation infrastructure in terms of principal–agent problems. The authors further proposed improved incentive structures and better budgeting methods to curb the principal–agent problem. The proposed improvements have been implemented by the UK government in practical policy for the provision of transportation infrastructure. The problem also occurs in the relationship between lenders and borrowers, and in the complex system of derivatives, credit default swaps, and other varieties of financial speculation. The recent admission by former Federal Reserve Chairman Alan Greenspan that he had made a mistake in trusting investment managers to protect the interests of their shareholders, reveals how this problem can become a threat to the public[4].

The problem manifests itself in the ways middle managers discriminate against employees who they deem to be "overqualified" in hiring, assignment, and promotion, and repress or terminate "whistleblowers" who want to make senior management aware of fraud or illegal activity. This may be done for the benefit of the middle manager and against the best interest of the shareholders (or members of a non-profit organization). Public officials are agents, and people adopt constitutions and laws to try to manage the relationship, but officials may betray their trust and allow themselves to be unduly influenced by lobby groups or they may abuse their authority and managerial discretion by showing personal favoritism or bad faith by hiring an unqualified friend or by engaging in corruption or patronage, such as selecting the firm of a friend or family member for a no-bid contract. The problem arises in client-attorney, probate executor, bankruptcy trustee, and other such relationships. In some rare cases, attorneys who were entrusted with estate accounts with sizeable balances acted against the interests of the person who hired them to act as their agent by embezzling the funds or "playing the market" with the client's money (with the goal of pocketing any proceeds).

Problems and limitations

The double-sided principal–agent problem (a model of corruption)

Template:Original research One limitation with the application of principal–agent theory is that the agent can also try to incentivize the principal. This is sometimes referred to as the double-sided principal–agent problem or sometimes more commonly as corruption.

One example, may be in the area of takeovers and top executive compensation:

It is fairly easy for a top executive to reduce the price of his/her company's stock—due to information asymmetry. The executive can accelerate accounting of expected expenses, delay accounting of expected revenue, engage in off balance sheet transactions to make the company's profitability appear temporarily poorer, or simply promote and report severely conservative (eg. pessimistic) estimates of future earnings. Such seemingly adverse earnings news will be likely to (at least temporarily) reduce share price. (This is again due to information asymmetries since it is more common for top executives to do everything they can to window dress their company's earnings forecasts). There are typically very few legal risks to being 'too conservative' in one's accounting and earnings estimates.

reduced share price makes a company an easier takeover target. When the company gets bought out (or taken private)—at a dramatically lower price—the takeover artist gains a windfall from the former top executive's actions to surreptitiously reduce share price. This can represent 10s of billions of dollars (questionably) transferred from previous shareholders to the takeover artist. The former top executive is then rewarded with a golden handshake for presiding over the firesale that can sometimes be in the 100s of millions of dollars for one or two years of work. (This is nevertheless an excellent bargain for the takeover artist, who will tend to benefit from developing a reputation of being very generous to parting top executives).

Similar issues occur when a publicly held asset or non-profit organization undergoes privatization. Top executives often reap tremendous monetary benefits when a government owned or non-profit entity is sold to private hands. Just as in the example above, they can facilitate this process by making the entity appear to be in financial crisis—this reduces the sale price (to the profit of the purchaser), and makes non-profits and governments more likely to sell. Ironically, it can also contribute to a public perception that private entities are more efficiently run reinforcing the political will to sell off public assets. Again, due to asymmetric information, policy makers and the general public see a government owned firm that was a financial 'disaster'—miraculously turned around by the private sector (and typically resold) within a few years.

See also

- Agency cost

- Contract theory

- Cost overrun

- Governance

- Rent seeking

- Strategic misrepresentation

- Structure and agency

- The Market for Lemons

Notes

- ↑ Agency Theory, Agency Theory Forum

- ↑ HKS.harvard.edu

- ↑ IEA.org

- ↑ Clark, Andrew (2008-10-24). "Greenspan - I was wrong about the economy. Sort of". The Guardian (London). Archived from the original. Error: You must specify the date the archive was made using the

|archivedate=parameter. http://www.guardian.co.uk/business/2008/oct/24/economics-creditcrunch-federal-reserve-greenspan. Retrieved on 2010-05-22.

Further reading

- Eisenhardt, K. (1989) Agency theory: An assessment and review, Academy of Management Review, 14 (1): 57-74.

- Flyvbjerg, Bent and Cowi, 2004, Procedures for Dealing with Optimism Bias in Transport Planning: Guidance Document (London: UK Department for Transport, June 2004).

- Green, J. R. and N. L. Stokey. 1983. "A Comparison of Tournaments and Contracts", Journal of Political Economy, 91, 349-364.

- IEA (2007) Mind the Gap—Quantifying Principal–Agent Problems in Energy Efficiency

- Murtishaw, S. and J. Sathaye, 2006. Quantifying the Effect of the Principal–Agent Problem on US Residential Use, Report LBNL-59773

- Nikkinen, Jussi and Sahlström, Petri (2004): Does agency theory provide a general framework for audit pricing? International Journal of Auditing, 8: November, 253-262.

- Rosen, S. 1986. "Prizes and Incentives in Elimination Tournaments", American Economic Review, 76, 4, 701-715.

- Sappington, David E.M., “Incentives in Principal–Agent Relationships”, Journal of Economic Perspectives 5:2 (Spring 1991), 45-66

- Stiglitz, Joseph E. (1987). "Principal and agent, The New Palgrave: A Dictionary of Economics, v. 3, pp. 966-71.

- Rees, R., 1985. The Theory of Principal and Agent—Part I. Bulletin of Economic Research, 37(1), 3-26

- Rees, R., 1985. The Theory of Principal and Agent—Part II. Bulletin of Economic Research, 37(2), 75-97